Budgets are about priorities. Without an approved budget, our leaders seem to simply throw money at everything. When nothing is a priority, everything becomes a priority, and inevitably, a lot of our hard-earned money gets wasted. Or worse yet, our government simply borrows more money, thus burdening future generations with more debt to pay for things today.

It is difficult to get Republicans, Democrats and Independents to agree on much these days, but everyone agrees that a major cause of our budget crisis is that the budget and appropriations process is broken. Congress routinely fails to even pass a budget and has only completed all of the annual spending bills on time in four of the last 34 years.

The Problem

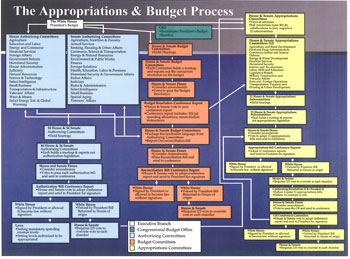

As they say, a picture is worth a thousand words. You’ll need to download a PDF of this chart to understand the budget process mess (click here, courtesy of G. William Hoagland), but here is a snapshot to give you a sense of the problem.

Some Ideas to Fix the Process

We know that changing the process alone will not solve the problem. But there are several common-sense reforms that can help to ensure that our elected officials will be more effective and efficient with our tax dollars.

Ending Spending will work to gather ideas to fix the process, and present them here. Some of the key process reform ideas are shared below, and you can read details about these ideas – and see who proposed them – in our Resources section.

- Anti-appropriations committee – Focused exclusively on cutting spending, it would be the antidote to runaway spending. Imagine a group of people who specialize in Ending Spending? Fantastic.

- Biennial budgeting – Under the current process, the Executive and Legislative Branch spend almost an entire year setting the budget and spending levels for discretionary spending for the following year. This causes our leaders to devote an enormous amount of time year after year debating a relatively small percentage of total federal spending. By converting the process to a two-year circle, Congress will have more time for oversight – the process by which Congress is supposed to review the effectiveness and necessity of government programs.

- Constitutional balanced budget amendment – The strongest of the solutions, a “balanced budget amendment” would amend our Constitution and require that the federal government spend no more money than it takes in. In the last thirty years, various forms of the BBA (as it is known) have come close to passing by the requisite majorities in the House and Senate. Maybe the current spending crisis will provide the impetus for amending the Constitution now? Some forms of the BBA also propose spending level restrictions and contain super-majority requirements to raise taxes.

- No more omnibus bills – Proposed legislation should be written in plain English, and to the greatest extent possible, should be limited to single issues. Members of the House and Senate – along with the public – should have time to read and review bills. The Senate should adopt the 72-hour bill review period enacted by the House earlier this year.

- Statutory spending limits (spending caps) and enforcement mechanisms (consequences) – While spending caps and enforcement mechanisms have been tried before (to mixed success), many Members of Congress are now pushing for a strict law capping the amount the government can spend annually with automatic cuts if those spending caps are violated. The two big questions with this approach are: (1) At what level should spending be capped? and (2) What categories of spending are covered by the caps and enforcement mechanisms?